In the last few years, Nubi has focused on expanding its product portfolio with business-oriented solutions. As a result, Nubi Z came on the market, revolutionizing the way companies offer benefits to their team members.

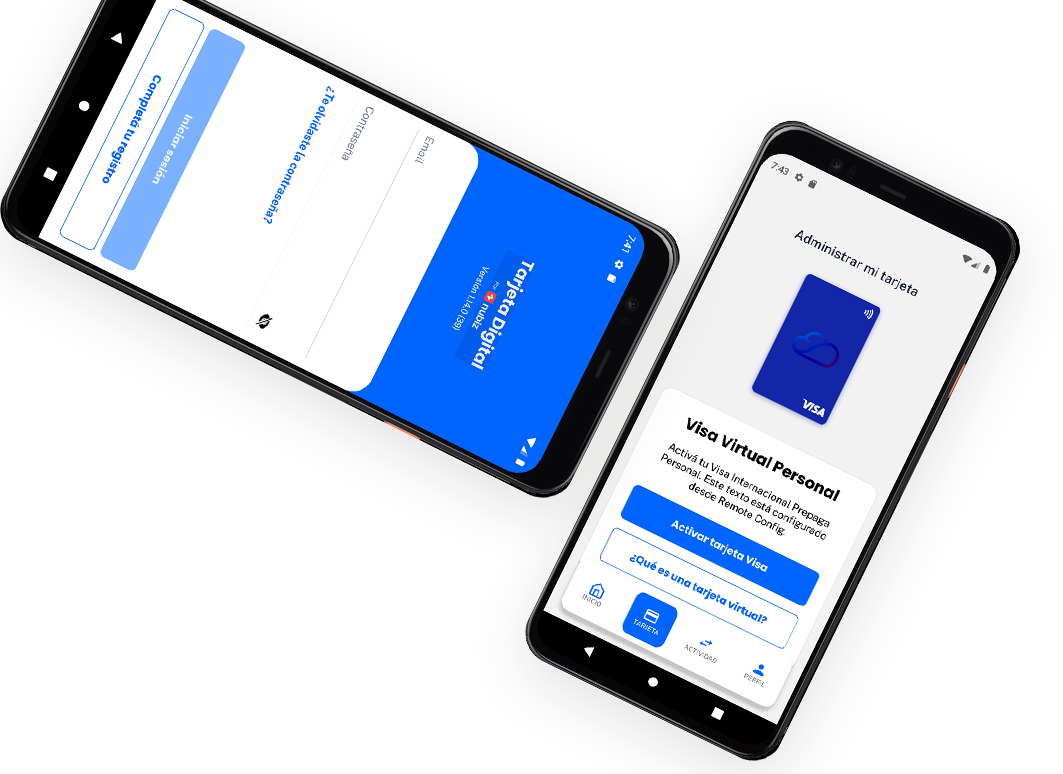

Through Nubi Z, a business can make agreements to assign a “debit card” to its employees, giving them the possibility to choose from a wide variety of benefits through it. Once the company has transferred funds to a Nubi account and the employee lists have been integrated, the funds can be distributed to the employees.

To make this possible, intive's engineers have investigated how to segment money allocation to configure that each employee has access to certain benefits in specific stores and categories according to their profiles. Through the implementation of microservices, the dev team has successfully modified the dispersion process and the update of debit cards.

Currently serving more than 23,000 users, Nubi Z stands out for being a very profitable product in terms of implementation time, and a customizable solution for its customers. As a result, employers can tailor their benefits to fit the specific interests of their team members in a fast and practical way.